(Translate for Kredittkort Med Beste Fordeler: Credit card with the best benefits)

There’s more to credit cards than the credit limit, interest rates, and associated fees and charges. When using a card, you gain benefits from each purchase you buy when you shop wisely. With rewards credit cards, cardholders can earn cashback, miles, or points that can be used in various ways.

The idea that you’ll be making the purchases anyway but receive benefits for doing so is ideal. The high-value rewards cards come with competitive rates, high earning potential, and minimal standard fees and charges. As the cardholder, you can maximize these benefits if you understand your card thoroughly.

The rewards will be for naught if you choose a card and only use it periodically. In order to get the most from the rewards, using it for any purchase, including online subscriptions, takeout, and monthly expenditures, can provide a few benefits.

With each transaction, you have ample opportunities to gain more miles, points, and cashback. The more you earn, the sooner you can redeem, but it requires using the card each day.

Tips On Maximizing a Credit Card for the Best Benefit

Most credit cards come with an interest-free period once you sign on. This timespan ranges from “20 to 55 days” based on your card type.

A priority is to take advantage of the interest-free period to pay the balance in full, helping you to establish a habit of doing that with each month’s bill even when the promotional period is over.

This prevents the accrual of interest or fees and charges while still accumulating rewards. While building these benefits, they need to be tracked and used regularly instead of letting them lapse, albeit use them wisely.

Credit cards allow users to review a rewards catalog with which they can decide what they want to redeem the rewards for and work towards that goal. Benefits can also be transferred to various loyalty programs like lodging or a “frequent flyer” program culminating into free lodging or flights.

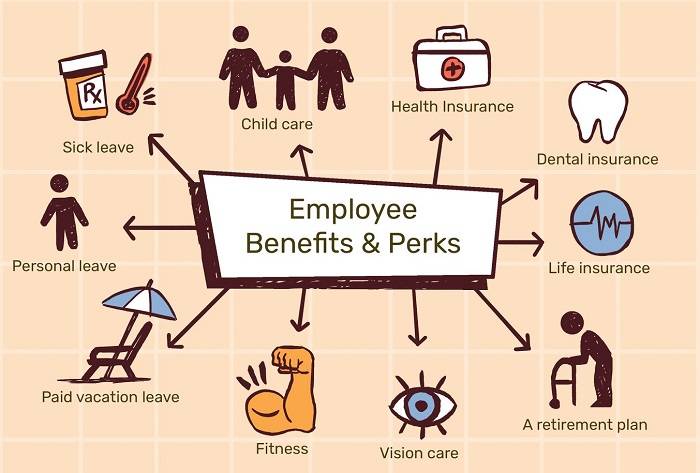

The perks

Aside from the rewards programs, many credit carriers offer cards with numerous perks. Some perks can include lounge access or a complimentary meal with a top-level restaurant based on your specific card. However, most perks come with conditions that need to be satisfied before taking advantage of them.

The conditions are typically relatively straightforward and easy to follow. That can include spending minimally, but the benefits always outweigh the expense.

Regardless of the bonus, benefit, or offer, indulging these is wise. They’re based on what you spend, making them advantageous.

Cash advances

One of the primary benefits of a credit card is that you can use it for virtually any purchase, but you can also withdraw cash from the card referenced as a cash advance.

The recommendation is that no one take a cash advance on their card. The reason is these charges are assigned a rate on top of what you will see for the standard charges. It applies from the time it’s withdrawn until it’s repaid.

A personal loan is much less expensive for those needing cash, particularly if you need a high borrowing amount.

What Are Some Tips on Making the Most of Your Credit Card Rewards

Learning the benefits, terms, and conditions is a priority when obtaining a new card. If you thoroughly understand the card and how the rewards, perks – and the conditions, apply, you’ll have the best chance to maximize these. Check here for details on cards that offer the greatest benefit.

Knowing you’ll be shopping or even paying bills makes more sense to do so using the card; this will essentially give you a little of that money back in savings. Here are a few tips to follow to maximize your rewards.

Match spending behavior with the benefit structure

Your habits and lifestyle should align with your rewards to make the most of them. Various credit cards offer an array of rewards with qualified spending, making it a priority to identify your spending habits, where you spend the most and on what.

Those traveling often should compare varied reward cards that offer boosted miles, points, and cashback, with travel expenses being a common use with the benefits. When you spend more at the market or with fuel expenses, search for a card with rewards in these categories.

For those who don’t have a specific category they must shop in, you can look for a “flat-rate cashback card” to serve you. You’ll be able to optimize your credit card rewards by checking those you have in your credit profile to ensure these correspond to your lifestyle and financial needs.

Optimize the benefits categories

If you have multiple cards, you’ll need to check to see which offers the better benefit package for what you need. Perhaps you’ve been using a flat-rate cashback card that offers market benefits at an unlimited 2 percent on purchases.

Still, you have a premium card paying “6 percent on the first $6000 spent in a year and then goes to 1 percent thereafter.” The 6 percent card is the better deal for now.

The sign-on bonus

Most credit card companies deliver a lucrative bonus simply for signing on with them. These can sometimes be earned in rewards of hundreds of dollars if the issuer’s conditions are met when the account is opened.

That usually involves spending a certain amount for the first several months after the card is activated for bonus eligibility. For eligibility criteria, you can check the bonus terms with your agreement.

The guidelines will detail how to manage your spending according to the terms. These bonuses can be financially helpful when applied to the installment or for a substantial expense.

As a rule, you should always spend money on what you need instead of buying more than you can typically afford. However, the welcome bonus timespan allows sufficient time to invest in something, whether a need or a want.

Choices when redeeming

The rewards portal with the credit card program will provide a detailed, informative outline of how you can redeem your rewards. Cardholders can choose direct deposit, statement credit, or an issued check with cashback cards.

When redeeming miles for holiday benefits like lodging or airfare, the portal will advise on the steps to take to do this. Points can be turned in for donations, merchandise, gift cards, and more.

The value when you redeem your rewards won’t be the same each time. In some cases, you could receive a one cent value for each mile, equating to minimal value. You may also see a required redemption option like cashback benefits used for a gift card.

If you’re a traveler, miles and points can often be higher valued when transferred to lodging or airline partners depending on the “rewards currency and the partner.” In most cases, the issuer will offer a higher value on holidays booked through their portal.

Use all of the perks offered with the card

Many rewards cards offer added benefits aside from the rewards that add value to the card. A travel credit card can have perks like lounge access with the airline, lodging credits, or insurance for baggage loss or delays.

Some cardholders will see discounts with travel insurance and other airline imperatives. Travel insurance can cover a holiday’s cancellation/interruption or delay. A lot of cards offer entertainment or shopping-related perks.

Sometimes, you could receive an extended warranty on a large purchase made with the card or promotions and discounts for shopping with specific retailers. Reward cards often also come with purchase or fraud protections.

It’s suggested that the higher the annual fee, the higher the quality of the perks. The high value reward cards with fees ranging as high as $500 will offer statement credits that can be used for shopping or qualified holiday travel.

When receiving perks, it’s essential to read the terms carefully to gain the complete value of the offer. When you use your rewards card wisely, you can often account for the annual fee from the benefits.

Many cardholders are typically most focused on how a rewards card can benefit them with possible earnings; the benefits and perks should be another primary consideration when selecting the best card.

They can create savings on regular purchases. Click here for guidance on minimizing the downsides of credit and maximizing the benefits.

Pay the full balance each month

When making any sort of purchase, it’s wise to put the expense on your credit card if you hope to make the most of your benefits. Transferring a revolving balance from one month to the next can negate the rewards earnings.

That’s due to the interest that compounds each month. After time, this can result in debt you’re unable to dig out of, and the card won’t benefit you. With any card, the recommendation is to keep the balance within a manageable range so the debt can be repaid with each bill.

When you avoid transferring a revolving balance to the next month, you’ll be able to enjoy the rewards associated with the card as well as the perks without accruing interest.

While the recommendation is to use the credit card for all purchases, ensuring you can pay that balance when the bill comes due before you overspend is still important. This is the formula for maximizing the benefits of your rewards credit card.

Must Be Check Out

110+ A Comprehensive Guide to Delivering a Speech on Time Management

115+ Heartfelt Happy New Year Wishes to Your Boss for a Prosperous Year Ahead

5 Benefits of A U-Shaped Desk for Maximum Productivity

120+ Energize Your Week with Inspiring Monday Morning Greetings

A credit card can be a great financial solution with the potential to earn rewards and take advantage of other benefits and perks. The priority is to use the card responsibly to get the most from these benefits.

That means putting most of your purchases on the credit card up to a reasonable limit and then paying that balance when the bill comes due. When you learn to maximize the benefits, you will get the most out of the card’s usage.