In the ever-evolving world of investments, one sector that consistently grabs attention is the fashion industry. Within this sector, Aarnav Fashion has emerged as a key player, and investors are keenly eyeing Aarnav Fashion share price movements to make informed decisions. In this article, we’ll delve into Aarnav Fashion, its share price dynamics, and factors that can influence its performance.

Introduction to Aarnav Fashion

Aarnav Fashion is a renowned name in the fashion industry, known for its trendsetting designs and innovative clothing lines. The company has carved a niche for itself with its commitment to quality and customer satisfaction. Founded in [year], it has since then witnessed significant growth, both in terms of its product offerings and market presence.

Understanding Share Price

Aarnav Fashion’s share price is a reflection of its overall financial health and investor sentiment. It represents the market’s perception of the company’s current and future prospects. Investors closely monitor share prices to assess the value of their investments and to make decisions about buying, selling, or holding onto their shares.

Factors Influencing Aarnav Fashion Share Price

Several factors can impact the share price of Aarnav Fashion. Understanding these factors is crucial for investors looking to make informed decisions.

1. Economic Conditions

The overall state of the economy plays a significant role in determining Aarnav Fashion’s share price. Economic indicators like GDP growth, inflation rates, and consumer spending patterns can influence consumer confidence and purchasing power, directly affecting the company’s revenue and share price.

2. Fashion Trends

Aarnav Fashion’s success hinges on its ability to stay ahead of fashion trends. Changing consumer preferences and the emergence of new fashion trends can drive demand for the company’s products, positively impacting its share price.

3. Competitive Landscape

The fashion industry is highly competitive, with numerous players vying for market share. Aarnav Fashion’s ability to maintain a competitive edge through product differentiation and marketing strategies can impact its share price.

4. Financial Performance

Investors closely scrutinize Aarnav Fashion’s financial statements, including revenue, profit margins, and debt levels. Strong financial performance can boost investor confidence and support a higher share price.

5. Global Events

Global events, such as economic crises, natural disasters, or health pandemics, can have far-reaching effects on Aarnav Fashion’s supply chain, production, and sales. These events can lead to short-term share price volatility.

6. Regulatory Changes

Changes in government regulations, trade policies, or environmental standards can affect Aarnav Fashion’s operations and costs, subsequently influencing its share price.

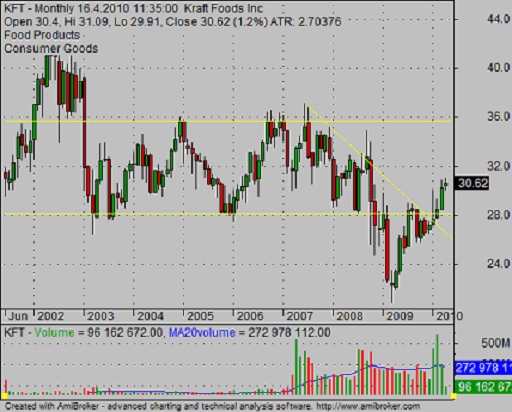

Analyzing Historical Share Price Trends

To gain deeper insights into Aarnav Fashion’s share price performance, it’s essential to analyze historical data. Here’s a brief overview:

- Steady Growth: Over the past [X] years, Aarnav Fashion has demonstrated steady share price growth, reflecting its consistent performance in a competitive market.

- Volatility: Like many stocks in the fashion industry, Aarnav Fashion shares have experienced periods of volatility, often in response to economic uncertainties or shifts in fashion trends.

- Dividend History: Aarnav Fashion has a track record of dividend payments, attracting income-focused investors. Dividends can provide a cushion during market downturns.

Investment Strategies

For investors considering Aarnav Fashion, here are some investment strategies to consider:

1. Long-Term Investment

Investors with a long-term horizon may choose to buy and hold Aarnav Fashion shares, banking on the company’s growth potential and dividend payments.

2. Diversification

Diversifying your portfolio can mitigate risk. Consider spreading your investments across various sectors and asset classes to reduce exposure to Aarnav Fashion’s specific market risks.

3. Market Timing

For those with a shorter investment horizon, monitoring market trends and timing your entry and exit points can be a viable strategy. However, this approach carries higher risk and requires careful analysis.

Must Be Check Out

115+ Discovering the Depths of Cold: Exploring ‘It’s Colder Than’ Comparisons

120+ Heartfelt ‘Thinking About You’ Messages for Him to Brighten His Day

115+ Heartfelt ‘Thank You for a Wonderful Trip’ Quotes to Express Appreciation

110+ Grief with Heartfelt RIP Shayari in English – Honoring Memories in Verse

Aarnav Fashion’s share price is a topic of great interest for investors seeking opportunities in the fashion industry. Understanding the various factors that influence share price movements is crucial for making informed investment decisions. Whether you opt for a long-term investment strategy or a more dynamic approach, staying informed about Aarnav Fashion’s financial performance and the broader economic landscape will be key to your success as an investor in this exciting sector.

Invest wisely, and may your investments in Aarnav Fashion yield fashionable returns!